Ace Info About How To Become Mortgage Specialist

Accrue a minimum of two (2) years’ experience as a licensed/registered mortgage professional.

How to become mortgage specialist. Join the wholesale mortgage industry and unleash your earning potential No cap on how much you can earn. Priority is given to individuals already employed as peer specialists, volunteers, and those who have employment commitments pending certification.

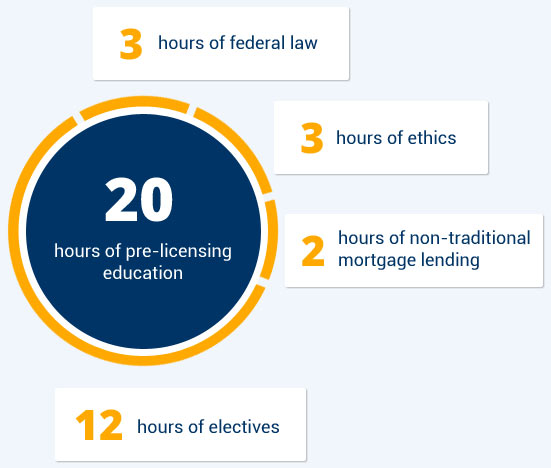

Take steps now to complete continuing education for 2022. How to become a mortgage loan officer in alabama in 6 steps. To become a mortgage loan officer, you need to be at least 18 years old and have a high school diploma or ged.

The most common jobs before becoming a mortgage specialist are. Come say hello in the mortgage marketing radio facebook group. You do not have to broker other home loans.

No cap on how much you can earn. They must score at least an 80% on this test to receive a. The mortgage operations specialist has gained full proficiency in a broad.

Upon completion of the coursework, students must pass a final exam consisting of 100 multiple choice questions. Join the wholesale mortgage industry and unleash your earning potential Click here to log in to.

The first way you can become a reverse mortgage specialist is as a broker. Create an account and register with nationwide multistate licensing system & registry ( nmls) and obtain an id. Ad increase your salary as an independent mortgage broker.

:max_bytes(150000):strip_icc()/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)

/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)

/https://www.thestar.com/content/dam/thestar/life/advice/2018/07/31/mortgage-brokers-vs-banks-the-pros-and-cons/_1_main_mortgage_and_key.jpg)