Sensational Tips About How To Protect Assets In A Foreclosure

Asset protection trust is a unique type of trust that enables you to secure a financial legacy for your future generations.

How to protect assets in a foreclosure. Examples of assets that may be considered. You don’t have to be irresponsible or negligent to get sued. To protect what you have, it’s vital to take some defensive measures, to make it more difficult for creditors to seize.

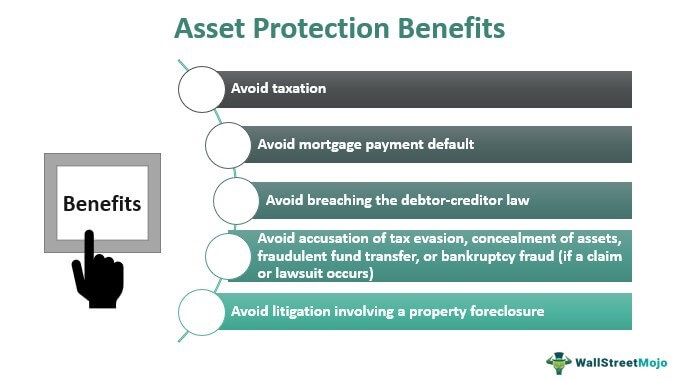

All states have laws prohibiting many types of transfers that are intended strictly to avoid paying an obligation. There is one downside, however, which is that it can be expensive and time. The plaintiff and his or her attorney would typically need to target the assets in the legal entity that holds the real estate instead of your personal assets.

Transfer cash, vehicle titles and other seizable assets to a family member other than a spouse or cosigner on your mortgage. Although the above strategies are beneficial, the. If you transfer assets in.

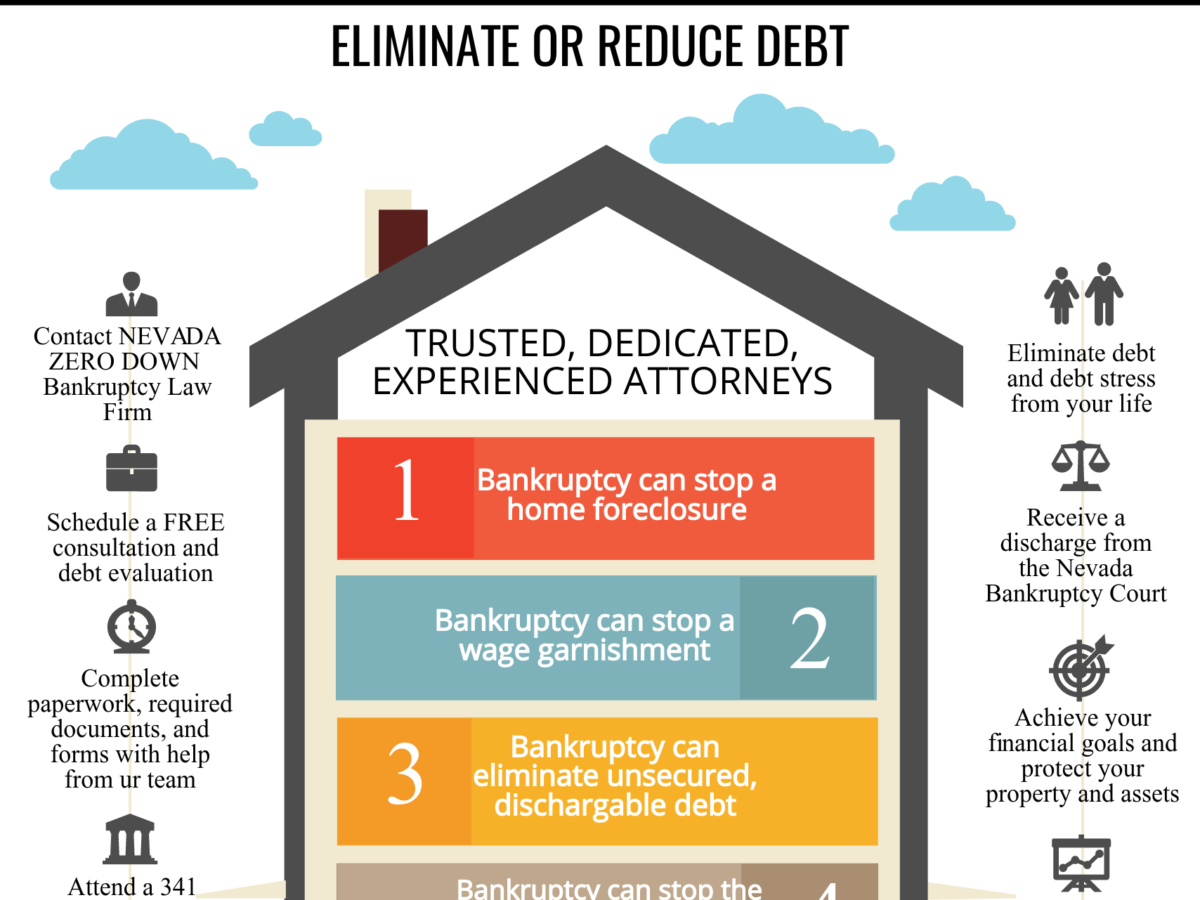

Wealth protection is a way to avoid litigation involving a property foreclosure or a mortgage payment default. Trusts are one of the safest methods to use to protect assets that are meant for a borrower’s beneficiaries. As for protecting your assets, there are some vehicles like asset protection/spendthrift trusts, so see a trust/estate lawyer for help.

Make additional payments on your. No matter what comes your way, you will be protected. The key issue in protecting assets from collection is usually that of timing.

A deficiency judgment is an unsecured debt, and therefore either chapter 7 or chapter 13. Incorporating your home into your overall asset protection structure provides as much security for all of your assets as possible. Use land trusts to protect your assets.

/GettyImages-81897314-1--576ecdd13df78cb62c51ee87.jpg)